Goods and Service Tax known as GST is one of the most awaited policies of the government. Since a long time there have been rumours about how GST will impact the real estate industry but finally things have come to an end as the government has decided the tax credit rates for real estate. This is definitely good news for marketers, investors and builders who had been waiting for it since a long time and now the rates are finally out.

As per the current GST rates, all the work contracts come under the 18% slab along with total ITC. Though these rates may appear to be a little higher but when taken as a whole, the market will be neutral. Most of the construction contracts come under work contracts and therefore both VAT as well as Service Tax are applicable on them. As per the current policy, the Service Tax has been kept 6% for now while the VAT ranges from 1 to 15%. The effective tax is now somewhere around 11-18% which is still under the lower slab and is sure to make a difference.

As per experts, the real estate market is sure to benefit from GST. Although it will take time to understand the policy and get used to it, in the long run the market will grow. Things will be neutral for some time and then the sales will pitch high. Thus, you can easily say that GST will play a big role in the industry after RERA and demonetisation. But unless GST is implemented, it is difficult to say how the market will behave or how things turn out to be.

Stamp duty as well as registration costs remain the same while completed projects and land will also be exclusive of GST. For real estate, GST would be 12% including the value of land and in case of separate agreements the applicable GST rate will be 18%.

There are many projects which are under construction and therefore these might get affected as the current rate would be high but for the new projects GST would be perfect and would definitely help in the growth of the sector and the industry. The main motive of the government for coming up with GST was just to bring in transparency within the country by keeping the rates same throughout, which earlier faced a lot of issues. This would simplify the taxation and make things clear for everyone.

Buying a real estate property is not easy. Though there are lots of options open before you but you need to be careful whether you are buying a genuine property or not. No matter how popular the builder may be but real estate is the sector where little things matter and you need to understand.

If any builder comes to you to sell their property, there are numerous things which you need to consider.

Firstly, you need to ensure whether the broker or the agent from whom you are buying the property is licensed or not. It is because brokers who are licensed are genuine and you can trust them. On the other hand brokers who are not licensed or certified may fool you thus taking your money away. So once you are sure of their credibility then only you should proceed with the buying process.

The agents need to register under the PRC and then only they become the part estate. There are five types of people in this category including the salesperson, brokers, assessors, appraisers and consultants. These people have to work under any company or professional and cannot buy or sell property on their own. They only need to assist the customers but cannot approach directly.

There are standards and limitations in the real estate sector too which need to be followed by the brokers or the agents. In case any broker is found violating the same, they can be punished and their license can also get cancelled. From time to time changes are made in PRC and therefore the brokers need to abide by the same and make sure they are fully aware of all the rules.

This is the reason that the buyers should be a little careful when getting in touch with any broker. You should first carry out complete research and once you are satisfied you should meet them and engage in property dealing or else you might become prone to any fraud case. Thus the buyers need to be smart enough and understand that they deal with the licensed professionals only.

A little understanding can make a lot of difference to the decision and can keep you away from all sorts of problems as well. So make sure you do not hurry when investing in any property but have inquired everything to take the right decision. This is for your betterment only so that you do not end up into a mess but buy a good property.

The real estate industry of India is one of the most loved sectors of all. No matter what the conditions may be but the people never stay behind in investing money in property. But since a few years there has been a decline in the popularity of the sector with people showing less interest in it. Still there are some people who have not kept themselves aloof and are always looking for brighter prospects.

So if you are one of those enthusiastic who feel that investing is definitely a smart thing you have come to the right people. Today we will talk about investing in property in tier 1 and tier 2 cities. The main question is that whether you should invest and if yes then what should be your choice.

Tier 1 Or Tier 2 Cities – Which Have Better Prospects

This is definitely a big question in the minds of the investors because the ultimate motive is to double their prices. Some of the experts are of the view that investing in tier cities is a good choice as the growth prospects are bright and there are higher chances that your property will be valued and you can get good amount for it. On the other hand there are people who hold the view that buying property in the tier 1 cities is a better choice especially with respect to the investment.

Then there is a third party as well which holds the view that there is no difference whether you invest in tier 1 cities or tier 2 cities, it is just about the location and the amenities offered. If both these things are excellent, there is no doubt that it will seek the attention of the people and you will be able to get a decent amount in return.

Investing Tips To Follow

But in case you hold a view that investing in tier 2 cities is a superb idea, you need to be careful and keep the below tips in mind.

- Investment is a bit tough in such cities and so you need to be smart enough to take the right decision.

- If you are not living in the same city you need to shoulder additional responsibilities which in turn is a big headache

- Regular inspection is needed or else you might lose the property

So it will be good if you look around nearby cities only as it will be easy for you to manage and handle it well thus keeping you stress free.

The Union Budget for the year 2017-2018 has already being rolled out and the much speculations about the real estate sector have come to an end. According to the budget, there is lots for the real estate industry with the Affordable Housing” being the key area of focus for the government. This scheme will definitely bring a difference as more participation can be expected from the private players thus helping to overcome the downfall condition of the market. The government has given a clear indication that will give “Affordable Housing”, the infrastructure status which in turn will prove to be a boon for it.

The move of the government is really good as it will help you to meet the rising demands of the homes and provide the same to many more people thus accomplishing the Housing objective by 2022. The emphasis is given to the first time buyers who are finding it difficult to buy a home for themselves but this new scheme will surely seek their attention. Efforts are being made to encourage more buyers to enter into the market so that they can take the advantage of the scheme.

In addition to the “Affordable Housing”, getting the loans on home will be made easy as National Housing Bank will make sure the loans of worth Rs 20, 000 crore to be given to the people in the year 2017-2018. Many other corporations as well as companies will be rendering their assistance in this case so that more number of people can make maximum use of the policy thereby bringing a change in their life.

Highlights of the budget for real estate

- Till 2019, 1 crore rural houses have to be created

- Rs 23,000 crore is given for the Pradhan Mantri Awas Yojana

- Special importance has been given to the transportation infrastructure and that is why an amount of Rs 2.41 lac crore has been sanctioned for it

- Changes will be made to the FDI policy

- There is tax benefit for the real estate developers too on the unsold stock

- Indra Awas Yojana will now be stretched to 600 districts

- 1 year tax break will be given to the unsold stock

- The time period for profit linked incentives is increased from 5 to 7 years which is yet another key aspect of the budget

In all the real estate has definitely got some great news as many policies will drift the market taking it to the next level.

The last quarter of the year 2016 has been very tough for the real estate. Though the year started on a good note and high sales but moving to the third quarter things really slowed down and the impact of demonetization was very clear. Not only the market went down but it also saw less participation of the buyers which in turn made the conditions worse. Though the overall idea of demonetization was to curb the black money but it did affect the real estate market in a negative way. Since then the market has not yet recovered but in the coming time, some positive trends can be visible.

If you look back at the last year’s market you will find that things were quite smooth and the market was flourishing. The experts were of the view that real estate would have touched new heights of success as so many fresh projects were initiated and the developers were trying their best to offer timely delivery. But all of a sudden this demonetization changed everything. Sales went down and even the prices got affected nearly to 20-30% which was definitely a direct loss for the developers and the builders. As the real estate involved a lot of cash transactions it greatly got affected thus bringing down the growth rate.

The economic conditions are deteriorating day by day. The GDP rate has also gone down with the market unable to cope with the existing conditions. Though a few months have passed and some sort of positivity has come into the market, the developers are still struggling to get used to the same as soon RERA will also be enforced. So the developers need to be very careful and ensure that sales do not go down but the buyers keep coming into the market.

The first quarter of the present year has seen some rise in the sales as buyers are now entering the market and booking the apartments for themselves. As the prices are low it is definitely a great opportunity for them to invest and buy their dream home. There are few new projects which have started and more will begin soon. It is expected that the sales will pitch up in the coming months with the real estate gaining that stability which is the need of the hour.

Till then we can just hope that things become better soon and the real estate developers bounce back with new expectations and aspirations.

Sometime back the government had introduced the demonetization policy to curb the black money but its consequences have been really severe. Though the motive has been fulfilled to a large extent but the market has suffered from a big blow. There are no new projects in the market and even the old ones are left in uncompleted state. Also the prices have gone down thus leaving the developers helpless. Since a lot of time the market was already slow but with demonetization it has come to a standstill. Both the developers as well as the buyers are trying to keep away as there is no hard cash available with them.

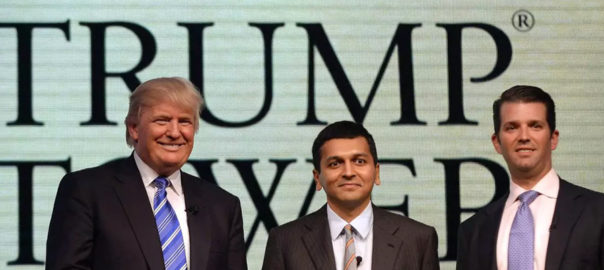

But after the elections in US has got over and Trump has taken the seat, there are good signs for the Indian real estate market to improve. It is because Trump has shown interest in the Indian market and wishes to invest in it. This is certainly a good indication as Indian real estate will definitely boost up as major projects will be initialized in different cities. The overall cost of the project is estimated to be around $1.5 billion which will definitely pace up the market. But it is just the brand that the Indian market will get while all the investments will be under the control of the US President.

The brand licensing agreements have already been signed and the projects will soon begin in cities like Mumbai, Kolkata etc. The US government has tied up with some of the reputed builders and developers of the real estate market so that they can come up with the finest and luxurious apartments spread in acres of land. Even Pune is one of the cities where the project will start soon with many popular personalities showing interest in it.

Though the Indian government will enjoy no investment in the projects but still the real estate market will definitely experience a boost which is need of the hour. Such an investment from US will not only help in improving the market conditions but useful for the economy as well. This in turn will influence the overall growth of the country which is crucial at this point of time. So there is no denial to the fact that such a big investment coming from the US will surely bring a revolution in the Indian Estate market with the developers already making the right use of the opportunity.

We have an Opportunity for you to invest small amount and get great benefit. Let’s Book Flats in Oshiwara

The demonetization policy introduced a few weeks ago has really affected the real estate market. Not only the prices have gone down but no new projects have been initialized. It is because the ban on the high currency has made the market to slow down with the cost being reduced to about 10-30%. Demonetization is definitely a big blow as market was really faring well with the sales being high and a number of new projects introduced by the developers. But currently things have become worst as projects are incomplete state as no funds are available for the same.

According to the experts, such conditions may exist for another few months until the prices become stable. Real estate market was one of the sectors that involved a lot of hard cash but the demonetization has surely stuck the investors and the developers hard. On one hand when the builders are unable to get resources to complete their projects, even the investors are finding it difficult to stake their money owing to the downfall in the market. The ban has made a negative impact on the real estate industry with things being at a standstill.

Though the developers are trying to come out of the situation but it will take time. Unless the market gets stable, it is very difficult to predict anything. But on one hand where the investors are juggling hard, the buyers are really happy as the cost has dropped and this has given them the opportunity to purchase home for themselves. The buyers who had already booked their homes are unable to get the delivery as the construction is yet not complete. On the overall the conditions are really favourable for the buyers and it is advisable for them to invest in property and buy a dream home for themselves.

Even the salaried people are facing issues and this is the reason that they have postponed their decision to purchase a flat at this time. Even they are waiting for things to get better and conditions become stable. Putting their money into real estate may not prove to be a great decision as the market is not doing well and nothing can be expected after seeing the present condition. Both the buyers as well as the builders will have to wait for the next couple of months. After that the market can rise and the industry may move towards a fresh path of growth.

Looking for 1 BHK apartment in Oshiwara? Then Sahyog Homes is one of the best options.